Exploring the realm of Best Low-Cost Insurance Options for Small Businesses Worldwide, this paragraph sets the stage for an enlightening journey, enticing readers with valuable insights and practical advice.

Delve into the specifics of insurance coverage, providers, and compliance in the following sections.

Overview of Low-Cost Insurance Options

Insurance is a crucial aspect for small businesses worldwide as it provides financial protection against unexpected events that could potentially disrupt operations or lead to financial loss. Having insurance coverage can help small businesses mitigate risks and ensure business continuity in the face of unforeseen circumstances.Key factors that contribute to low-cost insurance options for small businesses include the size of the business, the industry it operates in, the location, the level of coverage needed, and the claims history.

By assessing these factors, insurance providers can offer tailored solutions that meet the specific needs of small businesses at affordable rates.

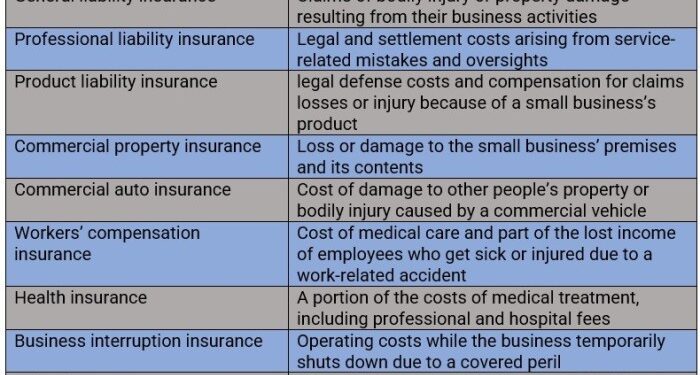

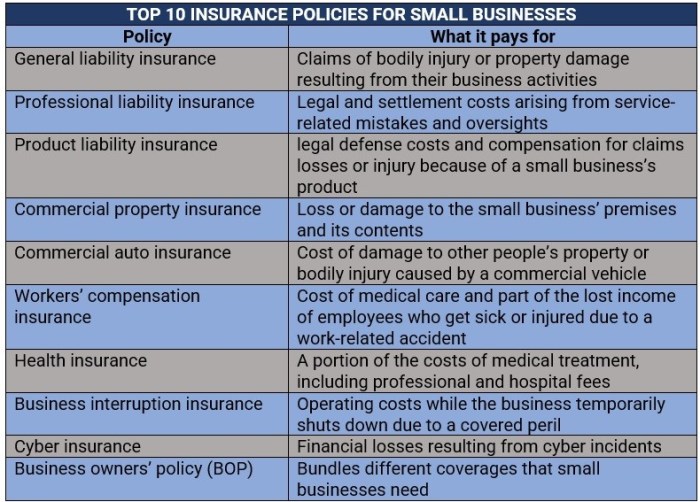

Common Types of Insurance Coverage for Small Businesses

- General Liability Insurance: Protects businesses from third-party claims of bodily injury, property damage, and advertising injury.

- Property Insurance: Covers damage to physical assets such as buildings, equipment, and inventory due to fire, theft, or other covered perils.

- Professional Liability Insurance: Also known as Errors and Omissions Insurance, it protects against claims of negligence or inadequate work performance.

- Workers' Compensation Insurance: Covers medical expenses and lost wages for employees injured on the job.

- Business Interruption Insurance: Provides coverage for lost income and operating expenses in the event of a covered disruption that forces the business to close temporarily.

Comparison of Global Insurance Providers

When it comes to choosing an insurance provider for your small business, considering global options can offer a range of benefits and drawbacks. Let's explore how different insurance providers cater to small businesses and how to evaluate their reputation.

Benefits and Drawbacks of Choosing a Global Insurance Provider

Global insurance providers often have a wider network and resources, allowing them to offer more comprehensive coverage and potentially better rates. However, the drawbacks may include less personalized service and potential communication barriers due to operating in multiple countries.

How Small Businesses Can Evaluate the Reputation of Insurance Providers

- Research online reviews and ratings from other small businesses to gauge customer satisfaction and experiences.

- Check the financial stability and ratings of the insurance provider to ensure they can fulfill claims and obligations.

- Consult with industry associations or local business groups for recommendations and insights on insurance providers.

- Request references from the insurance provider and speak directly with other small business clients to get first-hand feedback.

Affordable Insurance Policies for Startups

When it comes to insurance for startups, it's crucial to find budget-friendly options that provide adequate coverage. Here are some specific insurance policies that are affordable for startup businesses:

General Liability Insurance

- General liability insurance is a basic policy that covers third-party bodily injury, property damage, and advertising injury claims.

- This policy is essential for startups as it protects businesses from potential lawsuits and financial losses.

- Startups can customize their coverage limits based on their industry, size, and specific risks they face.

Business Owner’s Policy (BOP)

- A Business Owner's Policy combines general liability insurance and property insurance into one cost-effective package.

- Startups benefit from cost savings and convenience with a BOP, as it offers comprehensive coverage at a lower premium.

- By adding endorsements or riders, startups can tailor their BOP to include additional coverage options like cyber liability or business interruption insurance.

Professional Liability Insurance

- Professional liability insurance, also known as errors and omissions insurance, protects startups from claims of negligence or mistakes in professional services.

- This policy is crucial for startups in service-based industries like consulting, IT, or design, where errors could lead to financial losses or legal disputes.

- Startups can adjust their coverage limits and add-on options to suit their specific professional risks and client needs.

Legal Requirements and Compliance

Small businesses worldwide are required to fulfill certain legal obligations when it comes to insurance. Compliance with insurance regulations is crucial for the smooth operation and protection of businesses.

Importance of Compliance with Insurance Regulations

Compliance with insurance regulations is essential for small businesses to safeguard their assets, employees, and customers. Failing to meet these requirements can have serious consequences.

- Financial Penalties:Businesses that do not comply with insurance regulations may face hefty fines imposed by regulatory authorities.

- Legal Action:Non-compliance can lead to lawsuits from employees or third parties in case of accidents or mishaps that are not covered by insurance.

- Business Closure:In extreme cases, businesses that repeatedly fail to meet insurance compliance standards may risk closure by authorities.

Conclusive Thoughts

As we wrap up our discussion on Best Low-Cost Insurance Options for Small Businesses Worldwide, reflect on the key takeaways and empower your business with the right insurance choices.

FAQ Explained

What factors make insurance options low-cost?

Insurance options can be low-cost due to factors like coverage limits, deductible amounts, and the type of business being insured.

How can small businesses evaluate the reputation of insurance providers?

Small businesses can evaluate insurance providers by researching customer reviews, checking ratings from reputable agencies, and assessing the provider's track record.

What are the consequences for businesses that fail to meet insurance compliance standards?

Businesses that fail to meet insurance compliance standards may face penalties, legal action, loss of coverage, or financial repercussions in case of claims.