As Comparing Business Health Plans: Which One is Right for You? takes center stage, this opening passage beckons readers with a crafted world of good knowledge, ensuring an absorbing and distinctly original reading experience.

This topic delves into the nuances of different business health plans, shedding light on the key factors that can guide businesses in making the right choice for their employees' well-being.

Types of Business Health Plans

When it comes to choosing a business health plan, it's important to understand the different options available. Here, we will compare and contrast four common types of business health plans: HMOs, PPOs, EPOs, and HDHPs, so you can make an informed decision for your company.

HMOs (Health Maintenance Organizations)

An HMO is a type of managed care plan that requires members to choose a primary care physician (PCP) and obtain referrals to see specialists. This plan typically has lower out-of-pocket costs but limits the healthcare providers that can be used.

PPOs (Preferred Provider Organizations)

A PPO is a type of plan that offers more flexibility in choosing healthcare providers. Members can see specialists without referrals, both in-network and out-of-network, but they will pay more for out-of-network services. PPOs generally have higher premiums compared to HMOs.

EPOs (Exclusive Provider Organizations)

An EPO is a hybrid between an HMO and a PPO. Like an HMO, EPO members are required to use a network of providers, but like a PPO, they do not need referrals to see specialists. However, services rendered outside the network are not covered except in emergencies.

HDHPs (High Deductible Health Plans)

HDHPs are designed to have lower premiums but higher deductibles. These plans are often paired with Health Savings Accounts (HSAs) or Health Reimbursement Arrangements (HRAs) to help offset the out-of-pocket costs. HDHPs are becoming increasingly popular due to their cost-saving potential.

Considerations for Choosing a Plan

When selecting a health plan for your business, there are several key factors to consider to ensure you choose the right one for your needs. The size of your business, employee demographics, and specific healthcare needs all play a crucial role in determining the most suitable health plan.

Impact of Business Size

The size of your business can heavily influence the type of health plan that is most appropriate. Larger companies often have more bargaining power with insurance providers, allowing them to negotiate better rates and more comprehensive coverage options. On the other hand, smaller businesses may have limited resources and may need to opt for more basic plans to stay within budget.

Role of Employee Demographics

Employee demographics, such as age, gender, and overall health status, can also impact the choice of a health plan. For example, a workforce with a higher average age may require plans that offer more extensive coverage for chronic conditions and preventative care.

Similarly, businesses with a predominantly young and healthy workforce may opt for more affordable, high-deductible plans.

Cost Analysis

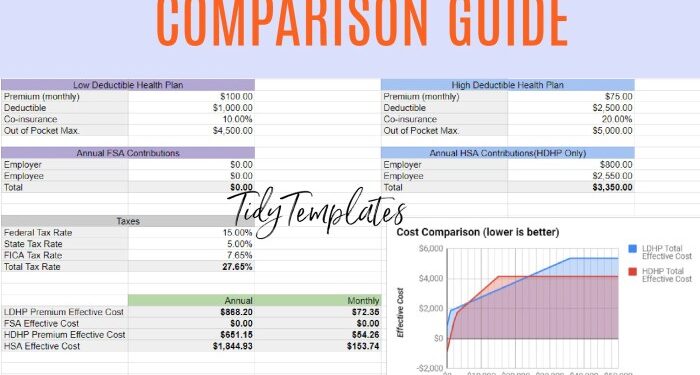

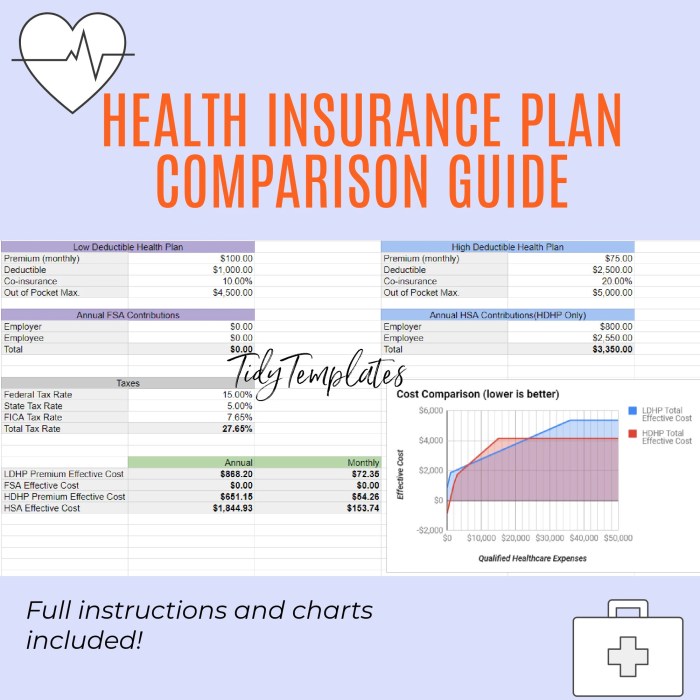

When it comes to choosing a business health plan, understanding the costs involved is crucial. Let's break down the different cost components associated with business health plans and how they vary across options.

Premiums, Deductibles, and Copayments

- Premiums: This is the amount you pay each month for your health insurance coverage. Premiums can vary based on the type of plan you choose and the coverage it offers.

- Deductibles: This is the amount you must pay out of pocket before your insurance starts covering costs. Plans with higher deductibles often have lower monthly premiums.

- Copayments: These are fixed amounts you pay for covered services, such as doctor visits or prescription medications. Copayments can vary depending on the plan and the type of service.

Cost-Sharing Mechanisms

- Coinsurance: This is the percentage of costs you are responsible for after meeting your deductible. For example, if your plan has 20% coinsurance, you would pay 20% of the cost of covered services, while the insurance company pays the remaining 80%.

- Out-of-Pocket Maximum: This is the most you have to pay for covered services in a plan year. Once you reach this limit, the insurance company covers 100% of the costs.

Coverage Options

When it comes to business health plans, coverage options can vary widely depending on the provider and plan chosen. Understanding the coverage options available is crucial in determining which plan is right for your business and employees.

Preventive Care

- Most business health plans include coverage for preventive care services such as annual check-ups, vaccinations, and screenings.

- Some plans may also cover preventive services at no cost to the employee, encouraging proactive healthcare.

Specialist Visits

- Business health plans typically offer coverage for specialist visits, allowing employees to seek care from healthcare professionals in various fields.

- Copayments or coinsurance may apply for specialist visits, depending on the plan.

Hospital Stays

- Most business health plans provide coverage for hospital stays, including inpatient care, surgeries, and other medical procedures.

- Employees may be required to meet a deductible or pay a percentage of the costs for hospital stays.

Additional Benefits

- Some business health plans offer additional benefits like dental and vision care coverage.

- Dental coverage may include routine cleanings, fillings, and other dental procedures.

- Vision coverage often includes eye exams, prescription glasses, and contact lenses.

Ending Remarks

In conclusion, the diverse landscape of business health plans offers a myriad of options, each with its own set of advantages and disadvantages. By understanding the intricacies of these plans, businesses can navigate the complexities of choosing the most suitable health plan with confidence.

FAQ Resource

What factors should businesses consider when selecting a health plan?

Businesses should consider factors like budget constraints, employee healthcare needs, network coverage, and potential cost-sharing options when choosing a health plan.

How does the size of a business impact the choice of a health plan?

The size of a business can influence the range of health plans available, as larger companies may have more bargaining power with insurers and access to a wider variety of plan options compared to smaller businesses.

What are the key differences between HMOs, PPOs, EPOs, and HDHPs?

HMOs focus on a network of healthcare providers, PPOs offer more flexibility in choosing providers, EPOs have narrower networks, and HDHPs typically have higher deductibles and lower premiums.